The role of analytics in identifying illicit business activities

When people say, “It’s a numbers game!”, you hardly ever think that they’re talking about anti-money laundering. While everything about tackling money laundering is tied to a number (account numbers, transaction amounts, etc.), banks have thus far been reactive, tightening up systems and checks, post facto.

Consequently, on failing to meet AML compliance requirements, these financial institutions often face fines to the order of several hundred million dollars – a definite dent to their financial growth. With an increasing shift to a proactive, risk-based approach across institutions, it’s time to revisit the role of analytics in mitigating money laundering, as opposed to it playing a more forensic role as an afterthought.

Challenges in implementing AML

Geographically diverse financial institutions with huge customer bases face many hurdles when meeting AML compliance, as key AML processes such as CDD and KYC are dynamic and resource intensive. Adding human resources to the compliance team not only raises staffing costs but hardly solves the problem when it comes to eliminating human errors, and might not, therefore, be the optimal solution. Scalable technological solutions that enable inter/intra-institutional communication are the way forward.

The multitude of avenues that enable fraudulent transactions in an economy extend well beyond common modes of moving and cleaning money. This is why data, in addition to expertise, is needed to combat money laundering across different organizational silos and business specific applications.

Big data makes a big difference

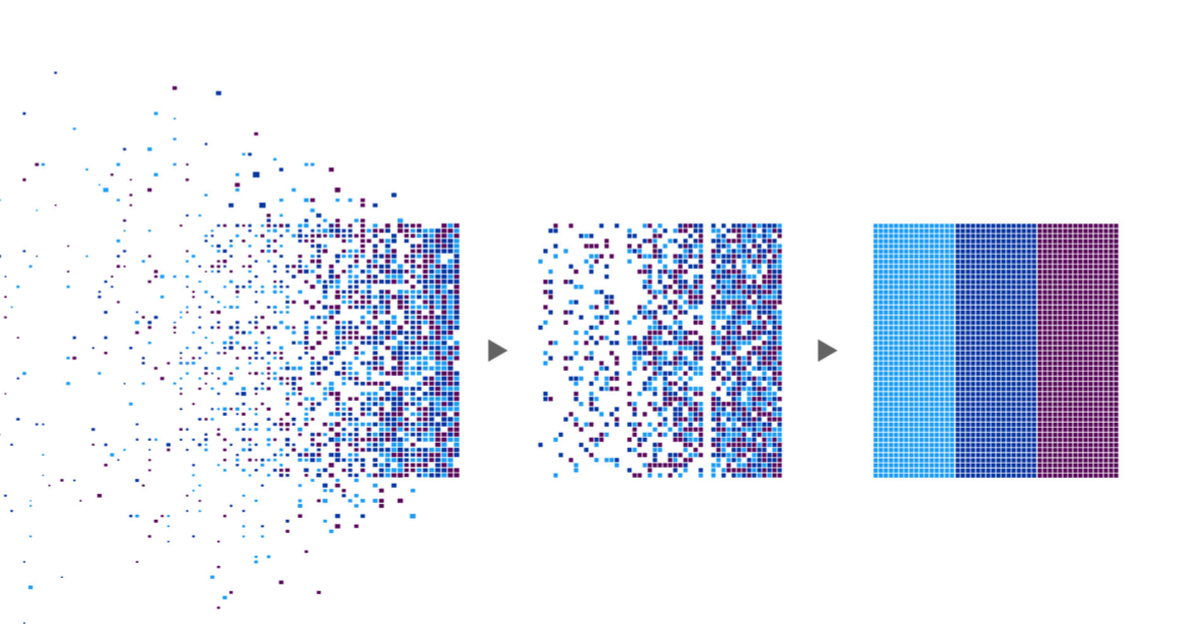

Big data analytics enables better insights into behaviour patterns by analyzing unstructured data from non-traditional sources such as social media, and other digital footprints, in combination with internal data and data from third party databases, to create a holistic picture of a customer. While conventional AML systems are query based, the dynamic nature of money laundering calls for real time data processing that is made possible with predictive modeling and unsupervised learning. Further, the divergent schema of these new data sources makes the traditional RDBMS a less viable option.

Machine learning simplifies case management and filing of SAR by using fuzzy logic to automate time consuming manual operations such as checking OFAC watchlists and scouring information from third party databases like LexisNexis. Superior algorithms for customer segmentation allow for 360 degree views of customers, and provide real time insights for ascertaining risk scores.

Additionally, changing regulatory environments are a big challenge for banks and other FIs. Big data analytics coupled with machine learning helps institutions dynamically adapt by overcoming the limitations of a traditional rule based TMS. AML programs can also continually learn about the topology of financial transactions across entities, and update AML rules, enabling accurate risk assessments, and reduced incidences of false alerts.

The way ahead

AML is also taking a new direction with cutting edge technologies such as blockchain that are closer to making decentralized regulation a reality. With new regulations and technological innovations, the AML world is in the brink of a radical transformation. Experts must look to make trade finance safer and more reliable by effectively utilizing big data and machine learning to replicate the human thought process and intuition.