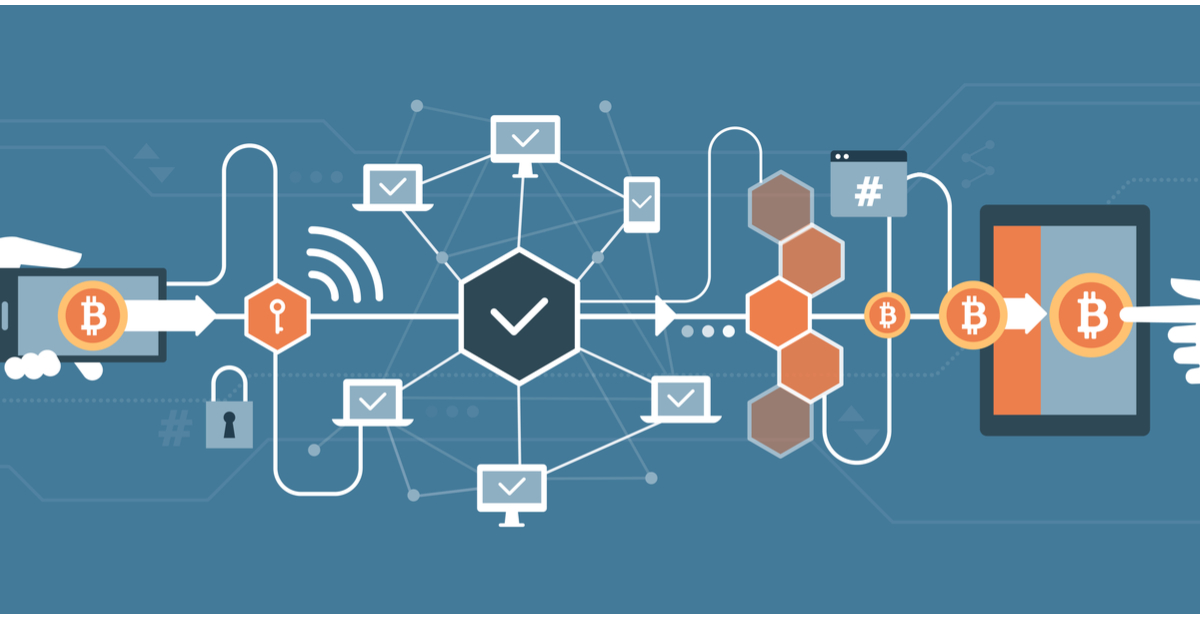

Payments Processing Using Blockchain

From Amazon Go to Google Pay, tech players are constantly trying to improve user experience by digitizing every conceivable step in the customer life cycle.

Instant fund transfers and payment systems were not the norm, even as recent as a decade ago. Come 2018, Mastercard, Visa, American Express, Bank of America and other big players in Banking and Finance already offer real-time payment solutions based on blockchain technology, making transactions swifter.

How blockchain can transform payments

Cross border payments, involving international bank to bank transfers and Trade Finance applications, take days to process and clear, with fees as high as 10 percent. Blockchains eliminate third party transaction records, thereby creating secure, quick, and cheap alternatives.

A common point of contention for many insurance providers is dispatching claims after a catastrophic event such as a natural disaster. Smart contracts, a key capability of blockchains, can be programmed to verify and enforce the terms automatically, thereby eliminating latencies in the process.

Further down the timeline, issues/disputes around incorrect orders, faulty delivery, and payment errors require employees to retrace steps through multiple records. As IBM’s blockchain implementation already demonstrates, blockchain’s decentralized tamper-proof digital records can speed up dispute resolution, reducing resolution times from 44 to 10 days.

However, blockchains may not eliminate the risk of fraud as access control security, and not systems security, has been the core issue in recent financial heists/cyber crimes. Therefore, the primary application of blockchain lies in the recovery of stolen money.

Innovations in payment

In a few short years, several new blockchain-based enterprises have entered the payments market. For example, Chronicled, a San Francisco based startup, has an innovative blockchain powered solution for supply chain management. Filling out and completing orders for every party involved in a supply chain requires a lot of coordination, reconciliation and security checks. Combing IoT, AI and blockchain, Chronicled helps organizations efficiently streamline the multiple disjointed payment systems within a supply chain.

Another venture, BitPesa helps individuals and institutions send and receive secure payments to Africa, without requiring bank accounts. Such solutions are extremely advantageous for countries that do not have adequate, or efficient local banking structure needed to support payments.

The way ahead

Blockchain has created a new ecosystem encompassing a wide range of players in cross functional domains. Enterprise Ethereum Alliance, a consortium of financial institutions, blockchain startups and tech firms, was formed in 2017, to “build, promote, and broadly support Ethereum-based technology best practices, open standards, and open source reference architectures.” In contrast, many banks and credit card companies are also patenting their speedy and secure blockchain based payment solutions.