How many is too many in AML staffing?

When it comes to KYC/CDD, an extra set of eyes can be a godsend. Regulatory authorities suggest a black & white outlook when it comes to compliance in financial institutions – either you’re keeping track of your customers or you’re paying exorbitant fines. Unfortunately, it’s not until you get down to the nitty-gritty, that you realise there’s more to compliance than having your customers fill out a few forms. And that’s where AML staffing becomes an integral part of the equation.

Compliance fundamentals

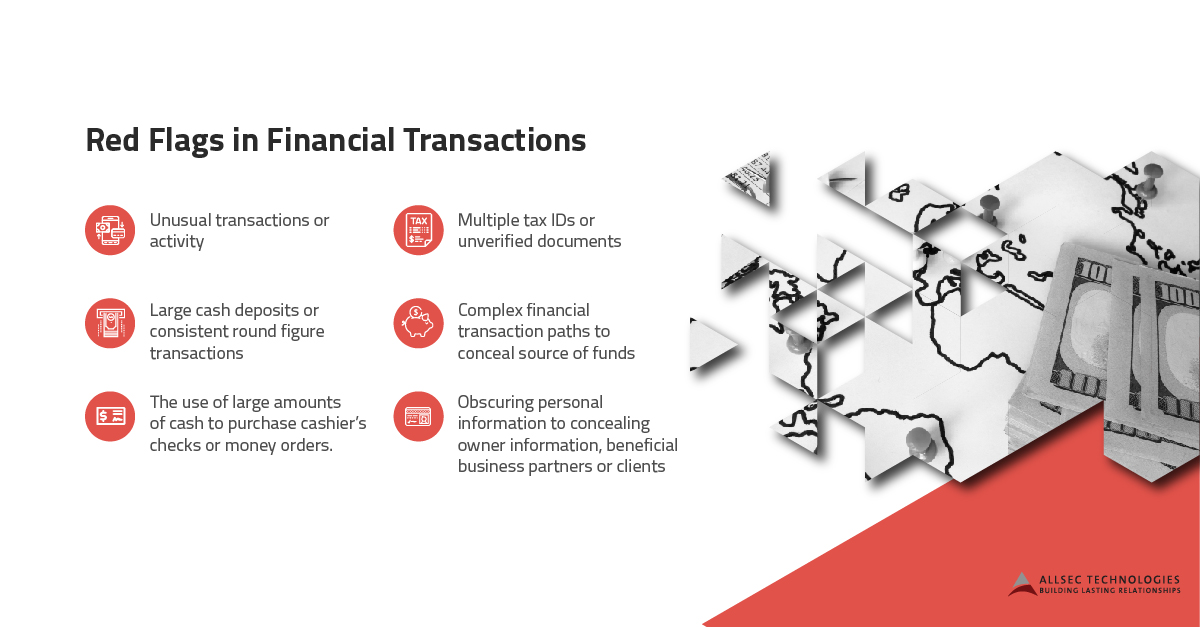

Constant monitoring of transactions, both online and offline, are essential to managing risk exposure. The following is a list of irregularities to lookout for.

While identifying red flags is key, compliance calls for delving deeper into the history of transactions, filing of SARs and updating of risk profiles. Augmenting these functions with AML technology can automate routine checks and improve efficiency.

Building blocks

Sustainable AML programs are resource intensive for the simple fact that you are looking for a needle in a haystack, or many needles in multiple haystacks. While you drive business opportunities through various offerings, you are also creating vulnerabilities in your system. The key to staying out of trouble is to create a strong, enterprise-wide compliance program.

The building blocks of an AML compliance program are:

- Written Policies

- Compliance Officer

- AML Agents

- Training

- Review

Of these, you can hire an expert or two to draw up policies that are in line with your business ideals. Since FinCEN only provides a guideline for a risk-based approach, you can implement system that is better primed to tackle potential fraud.

The people problem

An efficient solution is one that is executed perfectly, and when it comes to AML, the dependency on human resources is still enormous. While there are automation and machine learning technologies entering the fray, compliance programs are still largely people driven.

Organizations do their best to employ qualified individuals, but the primary obstacle to having the best team on board is that AML is a fluid vertical that not many people understand yet. The dynamic nature of regulations, constant ebb and flow of customer transactions, and lack of access to relevant training, make it difficult to hire right.

An AML staffing solution

Experts in the field of AML are few and far between, as it is a novel domain. However, you can have your pick of candidates by partnering with the right solutions provider.

Allsec has over 20 years of experience in the financial sector, and we have delivered accurate results for our banking clients with our AML solutions. Having started our own AML training academy, we are poised to leverage our expertise and provide staffing solutions as well.

Our superior screening process identifies potential candidates for all levels of responsibility within your AML program. We have filled the following positions at various globally reputed financial institutions:

- AML Analyst

- Senior Analyst

- SAR Writers

- AML Project Managers

- Senior Consultants

With competitive pricing models, we provide solutions that integrate well into any organization. By aligning the right candidates with your business objectives, we create a symbiotic relationship that drives results.

Our approach to AML staffing also allows us to provide consultants for specific projects, while managing benefits and retention in-house to reduce employee turnover.

To learn more about our AML staffing solutions, please write to us at aml@allsectech.com.