Catching up to a Dynamic AML Regulatory Environment

As regulatory frameworks evolve rapidly in stride with the growing volume of global transactions, it is imperative that FIs build sustainable AML programs to step up to the challenge of AML compliance.

According to a report by PwC, 19% of companies struggle to find competent AML staff, while an equal percentage has faced severe action from regulators for non-compliance.

As regulatory scrutiny increases globally, banks and FIs are required to investigate backlogged cases to strengthen their AML compliance programs. The transaction lookback process is long and complicated, involving a number of steps including:

- reviewing transaction alerts

- conducting expanded analysis for discrete cases in high-risk jurisdictions

- raising escalations,

each of which requires specialized know-how and wherewithal that many FIs struggle to access. However, Lookback can be seamlessly managed with the right people, process, and technology.

Proactive suspicious activity detection, KYC, case analysis, and other core compliance tasks are resource intensive, and often hijack resources away from strategic undertakings. Allsec addresses this challenge through multi-pronged service offerings.

AMLS

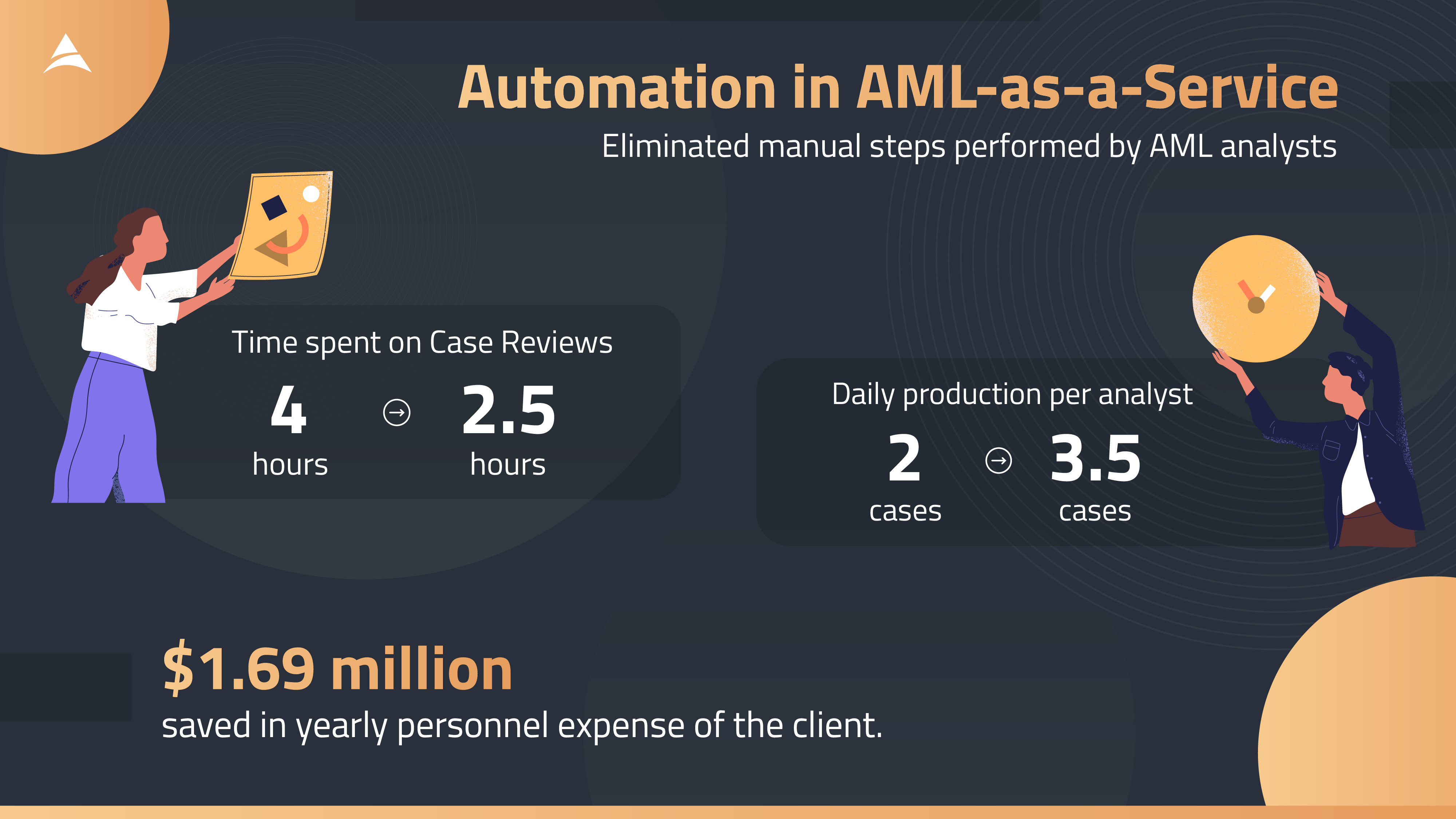

Our AML-as-a-Service solution is an investigative process built on machine learning technology to identify, model, and prevent questionable transactions. From Customer Identification Programs, OFAC and PEP screening, to Case Reviews, and Transaction Lookback, our AMLS program is holistic, flexible, and customizable to deliver quality results, regardless of scale.

Our multi-pronged approach to AML addresses these crucial aspects across all areas of AML compliance. What sets us apart is not only the cost savings from process improvements, but the 30-40% cost advantage over other consulting firms that our clients enjoy.

Staff Augmentation

Allsec’s body of expert staff including attorneys, military intelligence, former law enforcement and federal agents with in-depth regulatory experience can strengthen your AML program with their dynamic leadership, if your organization is hard pressed for resources to tackle AML compliance head on.

Our superior screening process identifies potential candidates for all levels of responsibility within the client’s AML program. We have filled the following positions at various globally reputed financial institutions:

- AML Analyst

- Senior Analyst

- SAR Writers

- AML Project Managers

- Senior Consultants

Enterprise Consulting

Backed by our domain expertise and technical know-how, we allow clients to access critical information that is otherwise not easily obtained. Through machine learning and advanced analytics, we offer insights that can help our clients accelerate compliance tasks such as customer on-boarding, and determine and prevent risky transactions through accurate risk assessments.

With global processes and comprehensive training, we deliver continuous process improvements for our clients.

For instance, by implementing a lean inventory management system based on analysis of historical performance trends, we increased over all inventory by 13% and productivity by 25%. This resulted in a $300,000 revenue increase for the client.

Training: Allsec AML Academy

With ever changing regulatory climate, it is essential for compliance professionals to keep themselves updated with the latest news, rules, tools and technology. AML compliance training, therefore, has to be hands-on and incremental in design and delivery.

Our training program, offered at Allsec AML Academy, is designed to cover: money laundering methods; role of FATF and other similar organizations that combat money laundering and terrorism financing; CDD/KYC, EDD and KYCC, and Suspicious Activity Reporting. Augmented with AI based tools, the program provides a hands-on experience for learners.

We train professionals from banking or finance, criminal justice and law enforcement, law, investigations or research, to be successful AML analysts. Training is one of our strongest areas and our students are groomed to work in multicultural contexts. Allsec AML Academy saved more than $1.2 Million in training cost for the client, a 50% reduction in expenses while reducing the duration of training to 2 weeks.

Through our specialized AML offerings, we assist banks and other financial institutions in developing sustainable AML programs to meet accelerating regulatory demands. By facilitating learning and capacity building in the field of AML, we strengthen our collective front in the fight against financial crime.